PAN Aadhar link online: The Income Tax Department, Govt of India released a notification to link PAN Aadhar last date. It is mandatory to link a PAN Aadhar card. If you do not link your PAN card with your Aadhar card, your PAN Number will be inoperative. All financial transactions may be disabled after 30 June 2023.

how can I link my Aadhar card with PAN online?

you can do the pan Aadhar link following these simple steps:

Step 1. Visit the Income Tax Department’s official website to link pan Aadhar.

Step 2. Now go to the Quick Link section on the homepage.

Step 3. Click on the Link Aadhar option which is given 3rd no.

Step 4. Now enter your information like PAN number and Aadhar card no.

Step 5. Now pay a penalty of ₹ 1000 through E-pay on the income tax e-filing portal.

Step 6. After successful payment and complete process follow again process from Step 1 to Step 4 after log in to one filing portal.

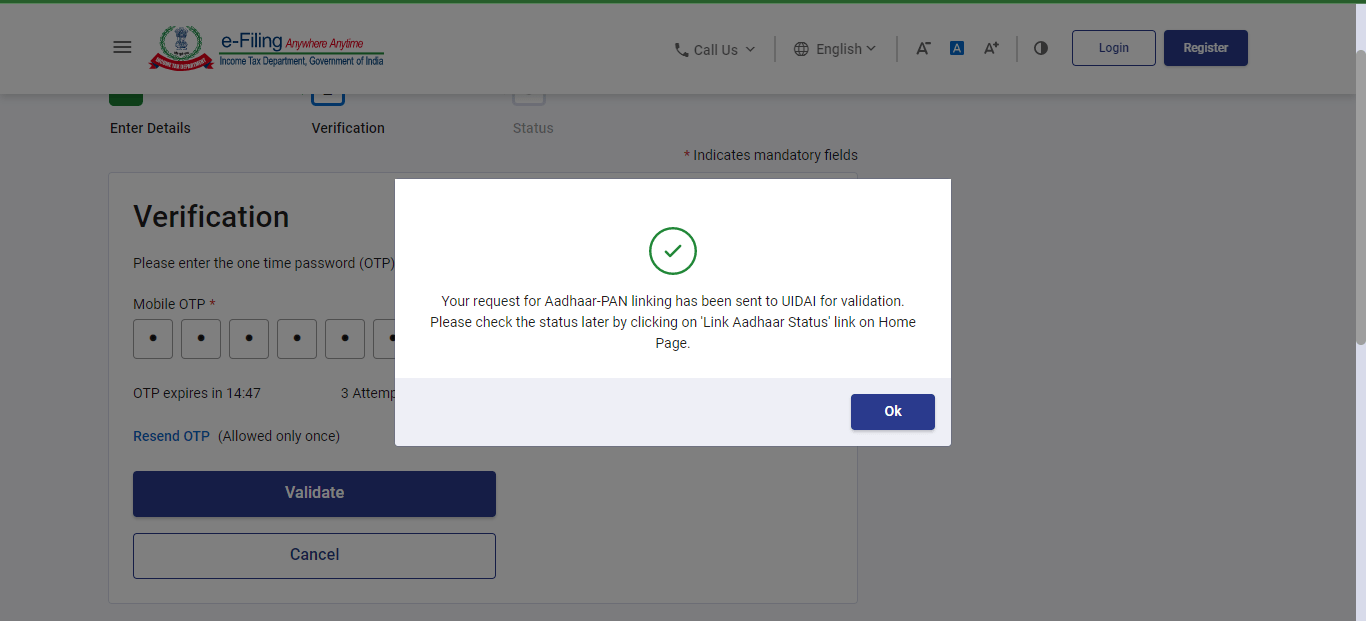

Step 7. Now you will get OTP, enter OTP and click on Link Aadhar

Now you will get a pop-up for PAN aadhar linkage.

Official Website e-filing

How are PAN cards and Aadhar cards linked?

If you forgot about your pan Aadhar linkage. Don’t worry check your pan Aadhar link status online. Note that if you don’t link your PAN Aadhar your PAN card number will be inoperative after the last date. So you need to link your PAN Aadhar before the last date.

If you want to check Pan Aadhar link status online before the Pan Aadhar link process follow these steps:

Step 1. Visit the Income Tax Department’s official website to link pan Aadhar.

Step 2. Now go to the ‘Quick Link’ section on the homepage.

Step 3. Click on the ‘Link Aadhar Status’ option.

Step 4. Now enter your details like – PAN Card number and Aadhar card number

Step 3. Click on the View ‘Link Aadhar Status’ option.

Now you will get a pop-up for PAN Aadhar Link status

The following categories are exempted from Aadhaar-PAN linking

FaQs related to pan aadhar link

1. how to check if aadhar and pan are linked?

Ans. You can check the pan aadhar link status online through the filing portal by following the process given in this article.

2. what happens if Aadhar and pan are not linked?

Ans. Your PAN card number will be inoperative if you are not linked.

3. are new pan cards linked with aadhar?

Ans. Yes, new PAN card holders do not need to link their PAN card Adhar card because it’s already linked.

4. consequences of not linking pan with aadhaar?

Ans. your pan card can be inoperative and your financial transaction may be held.

5. how can i link my aadhaar card with pan card?

Ans. you can link pan aadhar through the filing portal with simple steps. just visit the income tax department’s official website incometax.gov.in and go to the quick link section then click on link aadhar.

6. can we link aadhaar and pan with mobile online?

Ans. Yes, you can also link pan aadhar with mobile online at your comfort. just visit the income tax department official website incometax.gov.in and go to quick link section then click on link aadhar.

7. do nri need to link pan with aadhaar?

Ans. No, NRI does not need to link pan with aadhar according to income tax department notification because they are exempted.

8. does nri need to link pan card with aadhar card?

Ans. No, NRI do not need to link pan with aadhar according to income tax department notification because they are exmpted.

- how to link pan aadhar before 31 march 2023

- hdfc demamt account 2023 offer open free demat account

- How to book Unreserved Train Tickets through UTS app

- किसी काम का नहीं रहेगा आपका पैन कार्ड, जाने वजह

- मुख्यमंत्री लाडली बहना योजना 2023 ऑनलाइन आवेदन हेतु लिंक

- Phone Pe Loan kaise milta hai | Get Upto 5 lakh phone pe loan details free